IK Investment Partners to invest in APOSAN

IK Investment Partners (“IK”) is pleased to announce that the IK Small Cap I Fund has reached an agreement to acquire APOSAN Dr. Künzer GmbH (“APOSAN” or “the Company”), a leading pharmaceutical homecare company in Germany. Financial terms of the transaction are not disclosed.

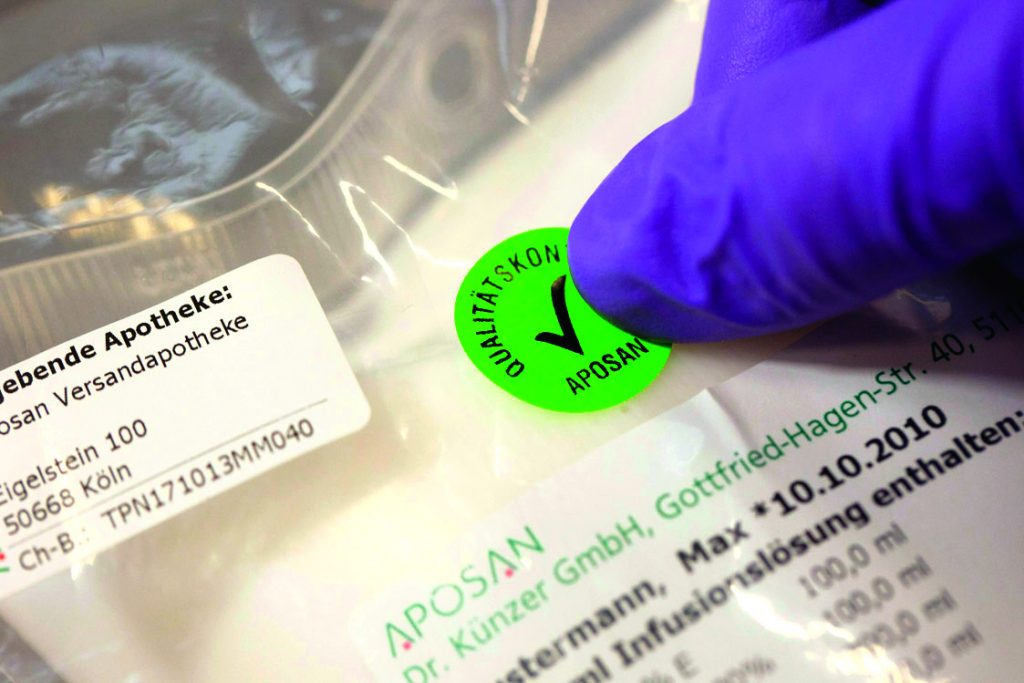

APOSAN was founded in 1991 by Dr. Clemens Künzer, with the purpose to service homecare patients through the compounding of individualised infusible and injectable medication. Since then, the company has evolved to an integrated full-range pharmaceutical homecare supplier with its own manufacturing capacities and a dedicated key account management and homecare nurses team to generate and support its growing nationwide patient base. The APOSAN group of companies is organised in three main business segments: pharmaceutical homecare, providing services to patients that require long-term infusion to diseases; classical homecare, providing standard enteral nutrition solutions as well as selected standard medical devices; and ophthalmic injectables. Founder Dr. Clemens Künzer will retain a substantial shareholding in the Company. The broad and experienced management team led going forward by Rainer Schmitz as CEO, Michael Schmitz as CSO and Claudia Vitiello as COO will also become shareholders and invest alongside Dr. Künzer and IK. APOSAN is headquartered in Cologne, Germany, and serves over 10,000 patients per year.

“Starting from the pharmacy Eigelstein in Cologne 25 years ago, APOSAN has grown to become a market leader within its niche, with integrated GMP production using state-of-the art clean room facilities. It has truly been a remarkable journey. As we now enter the next phase in our development, APOSAN will be led by a highly experienced management team with Rainer Schmitz as the CEO. The Company will also enter into a new partnership with IK, who has a strong track record in building successful companies,” says Dr. Clemens Künzer, founder of APOSAN.

“We would like to thank Dr. Künzer for his contribution over the many years. Led by its experienced and broad management team, APOSAN is well positioned to capture future growth, both organically as well as through selective add-on acquisitions. IK’s investment approach and track record has convinced the management team that we have chosen the ideal partner for APOSAN going forward, and their previous experience will support APOSAN as we embark on our growth trajectory,” says Rainer Schmitz, CEO of APOSAN.

“We are delighted to announce the acquisition of APOSAN, a market leader in the homecare services sector in Germany, an area in which IK has extensive experience thanks to its previous investments in the homecare space. APOSAN has attractive growth opportunities, targeting niches within the German homecare market, and a highly experienced and committed management team. We look forward to support APOSAN over the coming years,” says Anders Petersson, Partner at IK Investment Partners, and advisor to the IK Small Cap I Fund.

Completion of the transaction is subject to legal approvals.

For further questions:

APOSAN

Rainer Schmitz, CEO

Phone: +49 221 160210

Michael Schmitz, CSO (and responsible for PR)

Phone: +49 221 160210

IK Investment Partners

Anders Petersson, Partner

Phone: +49 40 369 88 50

Mikaela Hedborg, Communications & ESG Manager

Phone: +44 77 87 573 566

mikaela.hedborg@ikinvest.com

About IK Investment Partners

About APOSAN

As well as production, the company maintains a nationwide team of specialized nurses conducting trainings for patients on how to use and administer complex pharmaceutical therapies.

APOSAN works in cooperation with mail-order pharmacy APOSAN Versandapotheke (a division of Eigelstein Apotheke, Köln), via which delivery of pharmaceuticals is conducted. For more information, visit www.aposan.de