IK Investment Partners acquires LAP Group

IK Investment Partners (“IK”) is pleased to announce that the IK VIII Fund has reached an agreement to acquire LAP GmbH Laser Applikationen (“LAP” or “the Company”), a leading provider of laser positioning systems as well as quality assurance (“QA”) software and hardware used during radiotherapy treatments, from capiton.

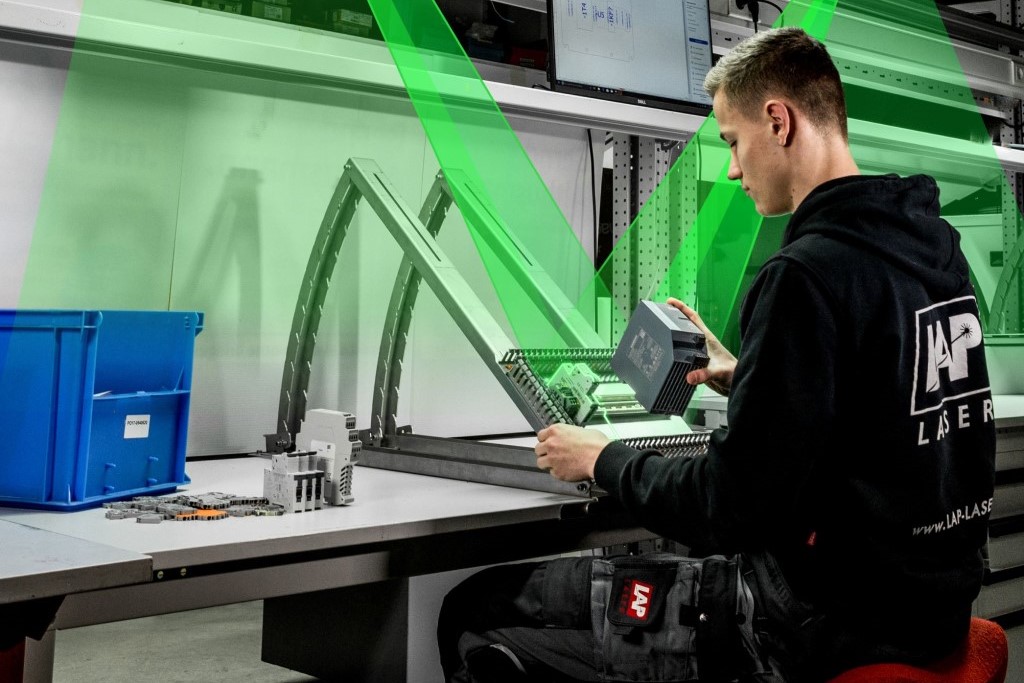

LAP was established in 1984 and has become a leading provider of laser measurement and projection systems used in highly attractive and diversified niche end-markets within the healthcare and industrial segments. The Company’s high quality, easy-to-use and reliable product portfolio is fit-for-purpose and meets customer as well as market-specific quality and regulatory requirements. LAP is the clear market leader for patient positioning systems and QA software used within the complete radiotherapy treatment workflow. Through its recent US add-on LifeLine, LAP also became the global leader in radiotherapy QA software. Headquartered in Lüneburg, Germany, the Company operates three manufacturing sites and employs about 350 people.

“With our high precision and easy to use measurement and projection systems, LAP has formed long-standing relationships with our global radiotherapy and industrial blue-chip customers. IK is the perfect partner as they have a genuine understanding of the medical technology as well as our various other end-markets and share our growth strategy. Together as partners, we will continue contributing to improve the efficacy of radiotherapy treatments and industrial processes,” said Uwe Bernhard Wache, CEO of LAP.

“We were truly impressed of what LAP’s management team has achieved in the past few years. Together we will continue to build on the strong market position, expand the promising QA software offering and enter new application areas. IK is well-positioned to support LAP thanks to our experience in medical technology through our acquisitions of KLINGEL medical metal in 2018 and Marle in 2016,” said Anders Petersson, Partner at IK and advisor to the IK VIII Fund.

LAP represents the IK VIII Fund’s third mid cap acquisition this year, and the 14th acquisition announced by the Fund. Financial terms of the transaction are not disclosed.

Parties involved:

IK Investment Partners: Anders Petersson, Alexander Dokters, Daniel-Vito Günther

Buyer financial advisor: Quarton (Konstantin Schönborn, Rolf Holtmann)

Buyer strategic due diligence: CODEX Partners (Clemens Beickler, Peter Engelhardt)

Buyer financial due diligence: Ebner Stolz (Claus Bähre)

Buyer legal advisor: Renzenbrink & Partner (Ulf Renzenbrink)

capiton: Andreas Denkmann, Manuel Hertweck

Seller financial advisor: William Blair (Philipp Mohr, Mark Brune)

Seller legal advisor: Milbank (Michael Bernhardt)

For further questions, please contact:

LAP Laser

Uwe Bernhard Wache

CEO

Phone: +49 4131 9511 95

IK Investment Partners

Anders Petersson

Partner

Phone: +49 40 369 8850

Mikaela Murekian

Director Communications & ESG

Phone: +44 77 87 573 566

mikaela.murekian@ikinvest.com