IK Partners enters exclusive negotiations to sell Exxelia to HEICO

IK Partners (“IK”) is pleased to announce that an affiliate of the IK VII Fund (“IK VII”) has entered into a put option agreement to sell its stake in Exxelia (“the Company”) to global aerospace business HEICO Corporation (NYSE: HEI and HEI.A) (“HEICO”).

Founded in 2009 from the merger of five long-established companies and headquartered in Paris, France, Exxelia is a leading manufacturer of complex passive components and precision subsystems for niche highly demanding industrial markets (defence, space, aviation, energy, transport, medical and telecommunications) where product reliability and superior performance is of utmost importance. Exxelia is recognised for its ability to design standard and custom products meeting complex technical specifications and the most stringent qualification procedures.

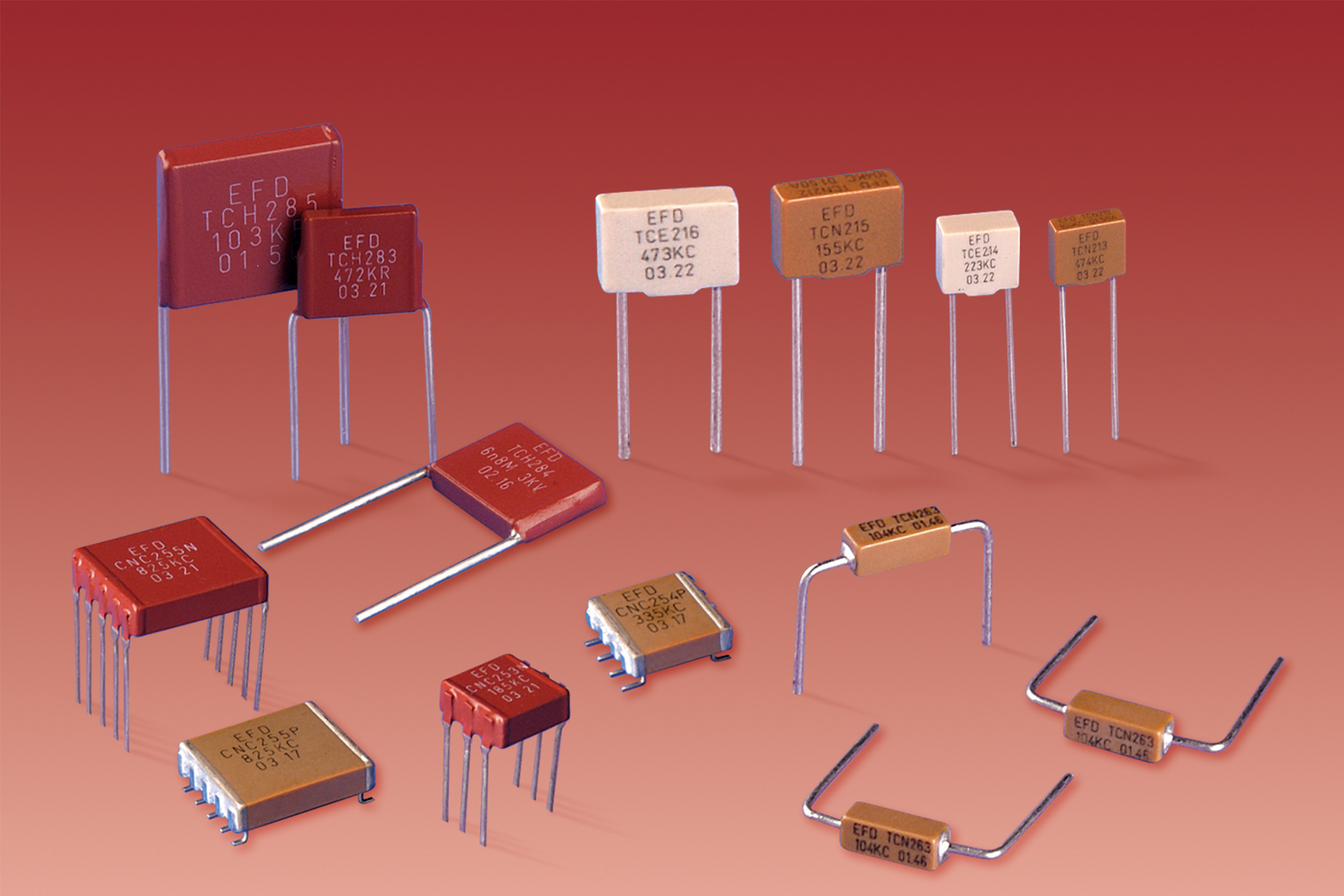

The Company operates from 11 manufacturing sites with more than 2,100 employees and serves blue-chip customers in more than 50 countries. It offers a comprehensive product range (capacitors, inductors, resistors, filters, position sensors and rotary joints) embedded into many programmes in partnership with its blue-chip customer base.

Since IK investment in Exxelia in 2015, the Company has successfully executed its strategic agenda, implementing an ambitious operational transformation plan and expanding its product portfolio and geographical reach through M&A. With the support of its new shareholder, Exxelia will be able to strengthen its operational excellence and innovation capabilities, pursue its international organic and M&A growth strategy and accelerate its development.

Paul Maisonnier, CEO of Exxelia, commented: “We are excited to embark on a new stage of development with HEICO. We really appreciate the values of the Mendelson Family, which match perfectly those of Exxelia. Our goal to develop Exxelia into a world leader in Hi-Rel passive components and sub-systems for harsh environments, serving the aeronautic, defence, space and medical markets will be accelerated under the Heico umbrella. Together we will strengthen our innovation and operational capabilities and accelerate our internationalisation strategy. We thank IK for their support over the past years, which has enabled us to establish a solid platform to support our ambitions for global growth.”

Dan Soudry, Managing Partner at IK Partners and Advisor to the IK VII Fund, and Diki Korniloff, Partner at IK Partners, added: “As shareholders of Exxelia since 2015, we are very pleased to have been able to support its very talented management team through the various stages of transformation, structuring and growth of the Company, doubling its employee base to more than 2,100 people and leading to a strong increase in investment in R&D and in its manufacturing footprint. We’d like to take this opportunity to wish the team and HEICO all the very best for the future.”

Laurans A. Mendelson, HEICO’s Chairman and Chief Executive Officer, along with Victor H. Mendelson, HEICO’s Co-President and CEO of its Electronic Technologies Group, commented: “We are ecstatic that such a fine company, with its remarkable team members, management and products, will be part of HEICO and we look forward to welcoming them to the HEICO family. While furthering HEICO’s strategy of expanding our already impressive range of mission-critical and high-reliability components for the most demanding applications, Exxelia also provides HEICO with added broad geographic and product diversity, including in the important European market.”

Following consultation of employee representative bodies, completion of the transaction would be subject to antitrust and regulatory approvals, notably in France.

About IK Partners

About Exxelia

https://exxelia.com/en/