IK Investment Partners has reached an agreement to sell APOSAN to Santé Cie Group

Santé Cie Group, a leading company in the French home medical assistance (HMA) market – offering medico-technical equipment, consumables and services to patients at home – announces the acquisition of a majority stake in APOSAN, a leading German pharmaceutical homecare provider and ophthalmic compounder. The stake will be acquired from the IK Small Cap I Fund, which is advised by IK Investment Partners. The acquisition is welcomed by Ardian, Group HLD, UI Gestion and Santé Cie’s management team who welcome APOSAN’s management team as a future minority shareholder in the Group. Santé Cie is majority-owned by Ardian.

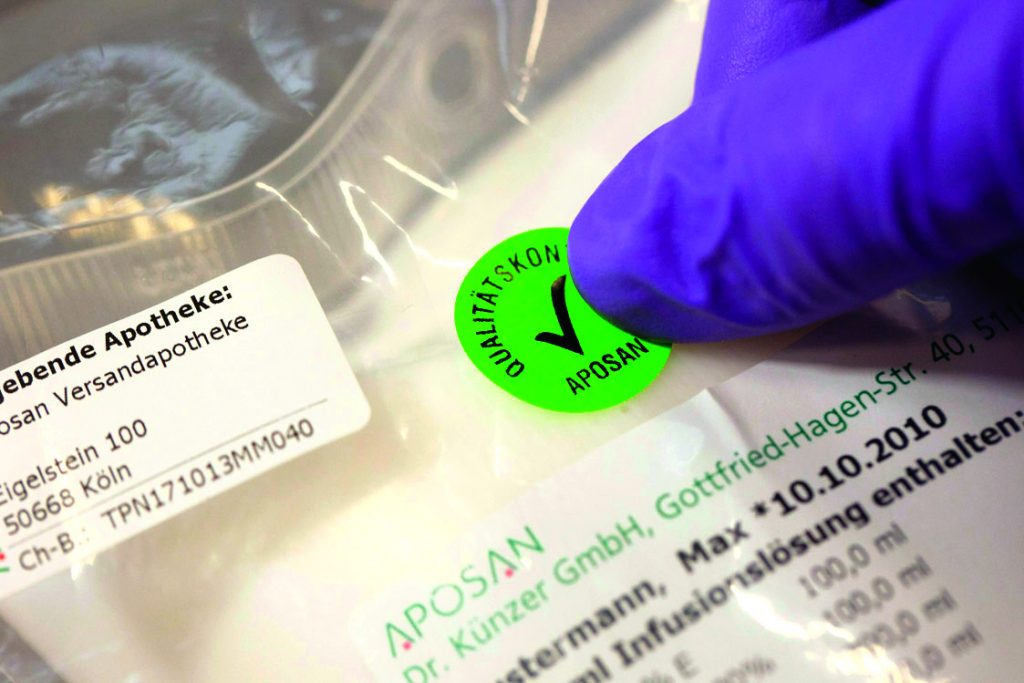

Founded in 1991, APOSAN is a leading specialised homecare provider in the field of outpatient parenteral antibiotic therapy, one of the fastest growing segments in the German home care market, as well as parenteral & enteral nutrition and ophthalmic injectables, covering the full homecare value chain from pharmaceutical compounding to care delivery. APOSAN is headquartered in Cologne, Germany, and serves over 15,000 patients per year.

In recent years, APOSAN has continued its successful growth strategy by rolling out its offering and new treatment areas to a growing patient base whilst investing significantly into its production capacity expansion, sales force and homecare specialists and increasing awareness of the advantages for patients, medical employees and healthcare systems of outpatient care in its core market segments.

Santé Cie’s internationalisation strategy is founded on a very attractive, well-managed and highly recognised platform in Germany. Santé Cie and APOSAN will build on their existing expertise and complementary offers to expand outpatient therapy indications and services. The Group will continue to innovate to improve the efficiency of care pathways in the face of new challenges posed by connected healthcare and telehealth.

Larbi Hamidi, Chairman of Santé Cie, said: “APOSAN boasts an entrepreneurial management team, highly-skilled employees and it represents a perfect addition to Santé Cie’s business. Its prime focus on perfusion and nutrition segments pairs exceptionally well with ours and we are impressed with the way APOSAN’s management has been able to build such a strong platform through autonomous growth. We at Santé Cie are very much delighted at the prospect of working together with APOSAN’s management and its employees, and supporting them in the next stage of their development through accelerating the company’s growth strategy.”

Rainer Schmitz, CEO of APOSAN, commented: “APOSAN has achieved strong growth over the past years and has made substantial investments in the Company. We would like to take this opportunity to thank IK Investment Partners for all their support, which enabled APOSAN to grow and expand its market position and offering. We now look forward to working with Santé Cie to further build on this success.”

Anders Petersson, Managing Partner at IK Investment Partners, said: “APOSAN has truly become the undisputed leader in the German pharmaceutical homecare market since we first partnered with the Company in 2016. It has been a pleasure working with APOSAN and its dedicated management team and we wish them all the best on their continued journey.”

Nicolas Darnaud, Managing Director within the Ardian Buyout team in Paris, said: “We are extremely proud to support Santé Cie in its first acquisition, which marks the beginning of the company’s international growth journey. APOSAN has an excellent track record and its performance stood out during the Covid-19 pandemic. We believe that the complementary nature of Santé Cie’s and APOSAN’s offers will enable the development of new and efficient solutions in the European homecare market.”

Alexander Friedrich, Managing Director within the Ardian Buyout team in Frankfurt, added: “This acquisition in one of our core sectors highlights Ardian’s multi-local approach and our strategy to support the development of companies into undisputed leaders in their respective markets, widening their offering and geographic reach with transformational add-on acquisitions.”

The joint company will serve more than 180,000 patients annually, with revenues of €300m+ and 1,850+ employees throughout France and Germany.

The transaction remains subject to antitrust approval.

PRESS CONTACTS

IK Investment Partners

Charles Barker Corporate Communications GmbH

TOBIAS EBERLE

Tel: +49 69 79 40 90 24

Tobias.Eberle@charlesbarker.de

ARDIAN

Headland

VIKTOR TSVETANOV

Tel: +44 207 3435 7469

VTsvetanov@headlandconsultancy.co.uk

LIST OF PARTIES INVOLVED

Sellside:

IK Investment Partners: Anders Petersson, Ingmar Bär

M&A advisor: Alantra (Wolfram Schmerl, Christopher Jobst)

Legal and tax advisor: Renzenbrink & Partner (Ulf Renzenbrink, Marc Kotyrba)

Commercial advisor: Alvarez & Marsal (Georg Hochleitner)

Financial advisor: Ebner Stolz (Claus Bähre)

Buyside:

Ardian: Yann Bak, Nicolas Darnaud, Alexander Friedrich, Nicolas Kassab, Matthias Straessle, Maxime Debost

Santé Cie: Larbi Hamidi, Alexandre Binetruy, Rémi Masson Regnault

Legal advisor: Weil, Gotshal & Manges (Barbara Jagersberger, Benjamin Rapp)

Commercial advisor: LEK (Stefan Schrettle)

Financial, tax and IT advisor: Eight Advisory (Murat Deniz, Jan Ole Burchert, Marc Bernstein)

Regulatory advisor: Clifford Chance (Peter Dieners)

Insurance advisor: Euro Transaction Solutions (Jürgen Reinschmidt)

About IK Investment Partners

www.ikinvest.com

About APOSAN

www.aposan.de

About Santé Cie Group

www.elivie.fr / www.asdia.fr