IK to sell Magotteaux to Sigdo Koppers

IK Investment Partners (“IK”) has reached an agreement with Sigdo Koppers, a leading Chilean mining supply and construction group, to sell Magotteaux for €550 million.

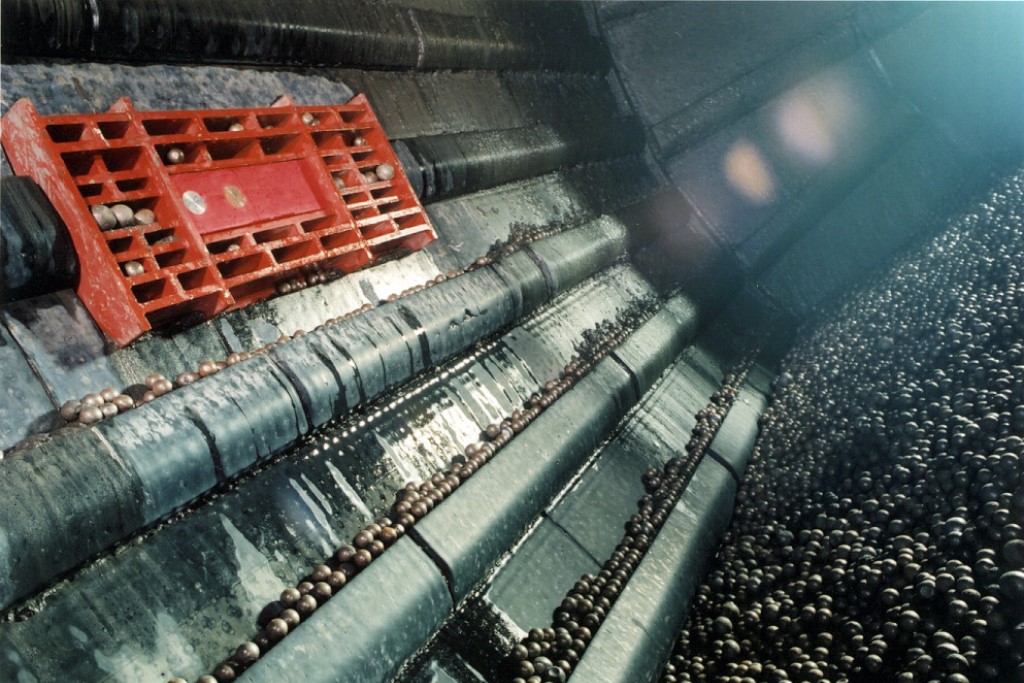

Magotteaux, based in Liège, Belgium is the leading global provider of differentiated high performance wear resistant consumables to industries, where crushing, grinding, and other comminution (i.e. material size reduction) processes are an essential step in the value chain. Its principal end markets are the mining, cement, aggregate, utilities and dredging industries.

Magotteaux’s products are sold globally and increasingly in emerging economies and fast growing mining geographies. The contribution of these geographies is expected to continue to increase as end market growth in Australasia (in particular China, India, Australia), and South America drives demand for Magotteaux’s products.

Since 2007, when IK acquired a majority stake in Magotteaux, the Company has developed significantly. Under IK’s ownership a number of major operational improvements have been successfully achieved, including adding a strong business performance orientation to the engineering culture; overhauling the approach to health & safety (man hours lost more than halved) and, applying tested operational excellence programs such as lower sourcing costs, reducing working capital and increasing on time delivery.

Secondly, IK has undertaken a major investment programme in both the core Belgian business and overseas over the last 4 years. Specifically, over €120 million has been spent on maintenance projects and on capex, the latter to support expansion into emerging markets such as Thailand and India. This has resulted in the introduction of several new products, a 15% increase in headcount, a one third increase in sales to €500 million and a two thirds increase in EBITDA to €66 million in 2011.

In line with its status as an industrial conglomerate within the mining and construction industries, Sigdo Koppers, plans to maintain Magotteaux as a stand-alone business, leveraging its strong market position to pursue industry consolidation opportunities.

Bart Borms, Deputy Director, IK commented: “The reshaping of Magotteaux is a great success. The Company commands market leading positions in both the mining and cement industries. As one of our portfolio companies, we invested heavily in R&D as well as capacity expansion but also supported a major operational improvement programme and overall strengthening of the organisation. With over 50% of production capacity now in high-growth countries, the Group is poised for superior growth. We are delighted with the financial returns we have achieved, but are also proud of the successful reshaping of the Group and its positioning for future growth. We believe Sigdo Koppers is the optimal new owner for Magotteaux and we wish the Company all the best.”

Bernard Goblet, CEO, Magotteaux said “The cooperation with IK has been positive for the group, and I would like to thank them for their professional guidance, support and investment. In partnership with IK, we have been able to transform the business and are now firmly established as a world – wide leader and are ready for the next stage of our corporate development.”

Juan Pablo Aboitiz, CEO, Sigdo Koppers said: “We are delighted that Magotteaux will join our group. It is a superb internationally oriented company, with high quality management and excellent development perspectives. We plan, with our own resources, to support Magotteaux’s expansion plans, and to create a worldwide group providing mining and industrial products and services.”

Kristiaan Nieuwenburg, Chairman, Magotteaux added: “Sigdo Koppers is eminently placed to support Magotteaux in the next growth phase, and help it consolidate its leading position in comminution. The Board would like to thank management and employees for their tremendous efforts and dedication over the past years, and the shareholders for their continued support.”

This acquisition is subject to customary conditions including anti-trust approval.

Morgan Stanley and Clifford Chance advised the sellers. BNP Paribas and A&O advised Sigdo Koppers.

Enquiries:

IK Investment Partners

Christopher Masek, Managing Partner

Tel: +44 20 7304 4300

Bart Borms, Deputy Director

Tel: +44 20 7304 4300

Charlotte Laveson, Communications manager

Tel: +44 20 7304 7136

Magotteaux

Bernard Goblet, CEO

(Jean-Yves Daxhelet)

Tel: +32 2 761 66 93

About IK Investment Partners

About Magotteaux

About Sigdo Koppers

Sigdo Koppers, had a turnover of 1.8 billion US $ and an Ebitda of 300 million US $ in 2010. The group is listed on the Santiago Stock Exchange and employs some 20.000 people. For more information: www.sigdokoppers.cl