IK Investment Partners to acquire SCHOCK

IK Investment Partners (“IK”) is pleased to announce that the IK VIII Fund has reached an agreement to acquire Granite Holding GmbH (“SCHOCK” or “the Company”), the world’s leading granite kitchen sink manufacturer, from HQ Equita. Financial terms of the transaction are not disclosed.

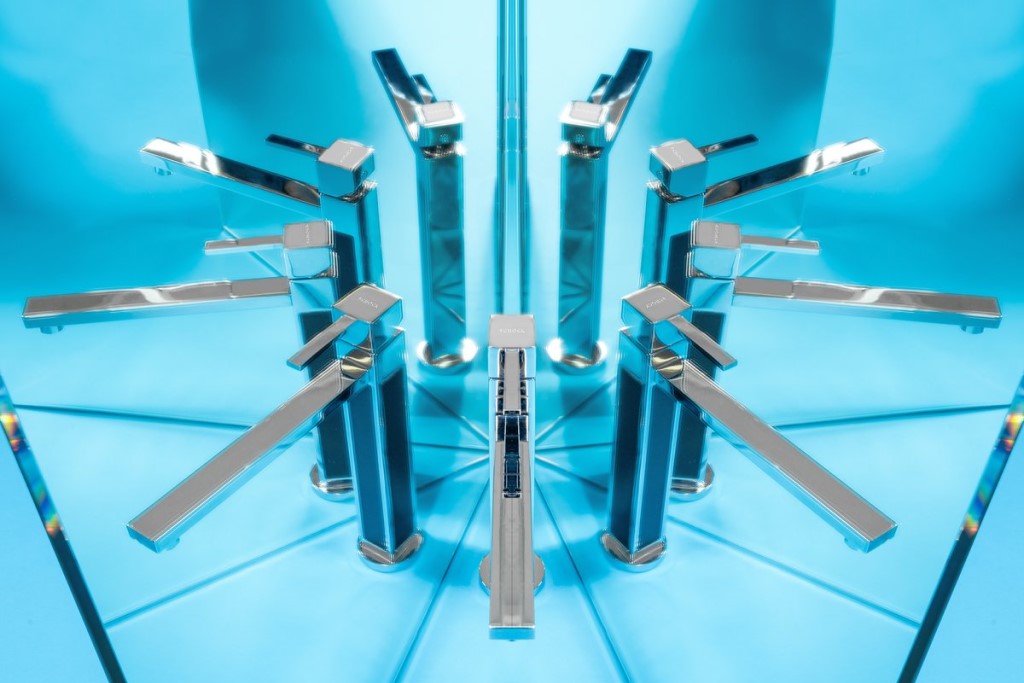

As the original inventor of the manufacturing technology commonly used in the production of granite sinks, SCHOCK has gained a reputation for innovation, quality and technological excellence. In fact, more than 60% of all quartz composite sinks manufactured worldwide are based on the production technique developed by SCHOCK. Based on a quartz-acryl composite developed by SCHOCK, the Company’s premium product is three times as hard as natural granite and superior in product performance to sinks made from other materials. The Company`s product line comprises sinks for every kitchen style and personal taste, with more than 200 sink models in as many as 40 different colours.

“We are on an exciting trajectory, building on recent product launches such as the CRISTADUR® EXTREME sink and on the repositioning of the SCHOCK brand. The Company is now well placed for the next phase of its development and IK’s industry expertise, excellent track record and broad network make them the ideal partner to help us achieve our long-term growth ambitions,” said Ralf Boberg, CEO of SCHOCK.

“With over 90 patents and a 21% global market share in granite kitchen sinks, SCHOCK is a high quality business and a true innovation leader within its niche. IK has a strong track record within the sector through investments in Hansa Group, Nobia and TCM Group and we are proud to have the opportunity to support the Company and its talented management team going forward. Together, we believe there are significant opportunities to grow the business both organically and through acquisitions while continuing to put the customers first,” said Detlef Dinsel, Partner at IK and advisor to the IK VIII Fund.

Completion of the transaction is subject to customary legal and regulatory approvals.

The acquisition of SCHOCK marks the IK VIII Fund’s second investment in Germany.

For further questions:

SCHOCK

GOOS COMMUNICATION GmbH & Co.KG

Ms Yvonne Deters

Geibelstrasse 46a, 22303 Hamburg, Germany

Phone: +49 (0) 40 284 17 87-20

E-mail: y.deters@goos-communication.com

IK Investment Partners

Detlef Dinsel, Partner

Phone: +49 40 369 88 50

Mikaela Hedborg, Communications & ESG Manager

Phone: +44 77 87 573 566

mikaela.hedborg@ikinvest.com